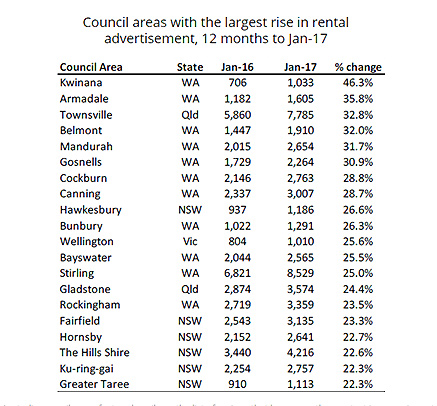

October saw an increase in the number of properties successfully leased by LJ Hooker Mandurah. In total we leased 37 properties across the month. The market continues to tighten in terms of the number of properties available to rent.

Today 2/11/17, there are only 482 properties available for rent in the 6210 postcode (source realestate.com.au), that is the lowest number of available rental properties over the last two years.

This is significant, as supply begins to tighten we should see prices begin to hold and the number of days that properties remain vacant should begin to drop.

As an investor now is the time to get your property on the market for rent. We still have a strong, healthy database of tenants looking for good quality properties.

If you’ve got a property to lease or are considering buying an investment property and need a professional, honest and knowledgeable team to advise you, and achieve the best results possible, contact me today.

Below you’ll see a full list of properties we leased throughout October with central Mandurah and Halls Head proving as popular as ever. For more information on the Mandurah rental market contact Mark Labrow 0431 025 449 (mlabrow.mandurah@ljhooker.com.au) or Jo Lockwood-Hall 0413 076 165 (jlockwoodhall.mandurah@ljhooker.com.au)

2/78 Gibson St Mandurah $285 p/w

18 Kaalak Lane Mandurah $295 p/w

14/106 Mandurah Tce Mandurah $340 p/w

17/15 The Palladio Mandurah $450 p/w

2 Kingdon St Mandurah $260 p/w

12 Lanyon St Mandurah $320 p/w

55/37 Dolphin Dr Mandurah $400 p/w

16 Elizabeth St Mandurah $200 p/w

9 Sandalwood Pde Halls Head $330 p/w

4a Oversby St Halls Head $350 p/w

38 Paradise Cir Halls Head $325 p/w

3 Oversby St Halls Head $525 p/w

29 Admiralty Cres, Halls Head $330 p/w

6a Bucentaur Place, Halls Head $230 p/w

9/11 Leslie St Dudley Park $230 p/w

5 Mast Close Dudley Park $335 p/w

8 Allora Close Dudley Park $290 p/w

15 Sharperton Mndr Dudley Park $320 p/w

7a Roy Rd Coodanup $290 p/w

11 Derek Road Coodanup $200 p/w

17a Veresdale Rt, Coodanup $210 p/w

2/3 Olinda Ct Greenfields $240 p/w

3 Berkeley Close, Greenfields $310 p/w

32 Redcliffe Rd Greenfields $380 p/w

5 Sandals Way, Meadow Springs $310 p/w

17 Camden Way, Meadow Springs $335 p/w

10 Formby Rd, Meadow Springs $300 p/w

38 Sabina Dr Madora Bay $400 p/w

32a Guillardon Tce Madora Bay $200 p/w

16 Fremont Cl, Secret Harbour $440 p/w

24 Geographe Bay Pass, Secret Harbour $310 p/w

21 Loretta Pkwy, Lakelands $340 p/w

3 Lea Wynd, Lakelands $370 p/w

18 Gamboge Ave, Karnup $300 p/w

54 Ronsard Dr, San Remo $380 p/w

97 Queen Pde, Wannanup $400 p/w

28 Boorabbin Dr, Baldivis $275 p/w

Halls Head, is always popular and is a consistent performer in the rental market. The number of properties leased in Halls Head in Q2 has in fact increased by 15, bucking the trend. In total 118 properties leased in Q2 with the median price per week of a home in Halls Head staying the same as Q1 at $330 p/w. On average 39 properties a month lease in Halls Head.

Halls Head, is always popular and is a consistent performer in the rental market. The number of properties leased in Halls Head in Q2 has in fact increased by 15, bucking the trend. In total 118 properties leased in Q2 with the median price per week of a home in Halls Head staying the same as Q1 at $330 p/w. On average 39 properties a month lease in Halls Head.

Mark Labrow

Mark Labrow Jo Lockwood-Hall

Jo Lockwood-Hall